Lu Hong, a 25-year-old nursing student at SUNY Stony Brook, migrated to the U.S. in 2004 from the eastern Zhejiang Province, China. Hong’s father, a Chinese businessman with a U.S. green card, spends two months a year in America and focuses the rest of the year on his booming construction business in China. After the financial crisis in 2008, Hong’s father discovered a new way to expand his business—by buying property for his daughter in America.

The young Ms. Hong is now a landlord of two properties in Queens. She first bought a large two-family house in Ozone Park at the end of 2008 and rented it to local Indian immigrants. In 2009, she bought a second two-family-house with a basement in Woodhaven, allowing her to live in one of the apartments and rent out the other. The rent she collects on her properties help pay her way through college. “We will buy more houses in the future,” she said.

Ms. Hong’s situation has become popular. Housing prices have dropped dramatically across the United States since the sub-prime mortgage crisis making it a good time for real estate investors. Ms. Hong bought her second property for $300,000 in 2009. Before the crisis, it would cost $560,000. But with Americas out of work in a struggling economy, increasingly it is foreign investors who are taking advantage of those real estate opportunities. Chinese investors often send their family members overseas to take care of their properties, collecting the rent and waiting for its value to appreciate.

“We bought it at the lowest price, though the economy is still bad, we are not worried,” said Hong. “What we need to pay every year is just the $3,000 property tax.”

Hong’s property is situated near the newly developed Chinatown in Flushing, Queens. On Main Street, numerous lawyers cater to foreign investors looking to buy New York real estate. “Now almost 50 percent of my business is coming from China,” said Mei S. Chen, a lawyer who has worked here for more than 15 years. “But before 2008, there was none; since early 2009, I have five to six cases every month.”

Ms. Chen said her Chinese clients buy houses ranging from a $400,000 condominium in Flushing to a $1.5 million luxury home on Long Island. Despite the price range one thing in common is that “they care about school very much.”

One of Chen’s clients is Ms. Wang. She bought a $900,000 house in Great Neck on Long Island from Chen in 2010. Wang’s husband, who works in a major enterprise in northern China, helped her invest in the property. She chose Great Neck because of its natural environment, but the most important reason is sending her son to receive an education in America. “I want my son to have the best education,” she said.

Wang’s son goes to Great Neck South High School, one of the best high schools in the New York area. In the past year, Wang has noticed an influx of Chinese immigrants to the neighborhood. According to U.S. News and World Reports Best High Schools list, Great Neck South High School ranked 61 in its top 100 list with an enrollment of 34 percent Asians.

“Chinese have always cared about education,” said Lily Costa, a real estate agent of Selective First Realty, whose business includes Flushing and Long Island. “For the most of the time school is the number one concern.”

Costa said the School District 25 (Flushing) and School District 26 (Bayside and Fresh Meadow), along with Great Neck, Manhasset and Roslyn on Long Island are extremely popular for Chinese investors because of the high quality public school education. “They [investors] are very sure that a good school district will only increase the value to their houses in the future,” she added.

Joshua Feng, a real estate agent who has businesses in China and the U.S. argues that part of the focus of Chinese investors hunting for schools in America is because they themselves didn’t have access to education in China. Many of them lost their chance to go to school during the Cultural Revolution in the 1960s and 1970s. Though successful in starting businesses, they often have difficulties in managing their business because of their lack of proper education. So they want their children to go to the best school in the U.S. and then go back to China to help with the family business.

“Most of my clients are extremely busy, they have to deal with their business in China every day” said Mr. Feng. “If their family members are not in the States, I just send them pictures of videos of the houses and they will tell me if they want to buy it in a few hours.”

Many Chinese buyers are paying for homes in cash which gets them further deals. Since bank loans are hard to come by these days sellers are willing to slash prices for cash buyers. “Generally, the sellers like Chinese buyers very much,” said Mr. Feng.

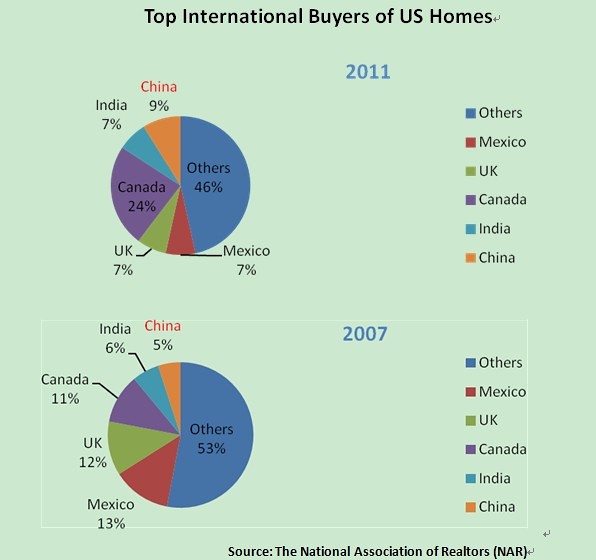

Chinese homebuyers made up 9 percent of the $41 billion in international sales for US homes, according to an annual report from the U.S. National Association of Realtors in March 2011. Before the financial crisis in 2007, Chinese buyers made up only 5 percent of sales.

Eager to boost the sluggish housing market the U.S. is now looking to promote the spike. In Oct 2011, a bipartisan “house-for-visa” bill was proposed by senators Charles E. Schumer (D-NY) and Mike Lee (R-Utah) to inspire foreign investment. The bill would offer a three-year residential visa for foreigners who invest at least $500,000 in the housing market, provided they live in the purchased property for at least 180 days a year.

“If they pass the bill,” said Mr. Feng, “I won’t be surprised if Chinese people come to buy the entire New York City.”